Contact we will be able to get free consultation of 30 minutes and offer solutions.

Contact we will be able to get free consultation of 30 minutes and offer solutions.

United States

+ 1 507 3859886

Singapore

+ 65 86200187

China

+ (86 21) 60450886

Email contact info@rtfcpa.com

We will contact you within 24 hours.

2018-06-30

2018-06-30

As the world’s second largest economy, China is one of the most attractive countries to invest in. If you are interested to invest in the Chinese market, please have a look at the guide below, where, we try to clarify all your questions and concerns.

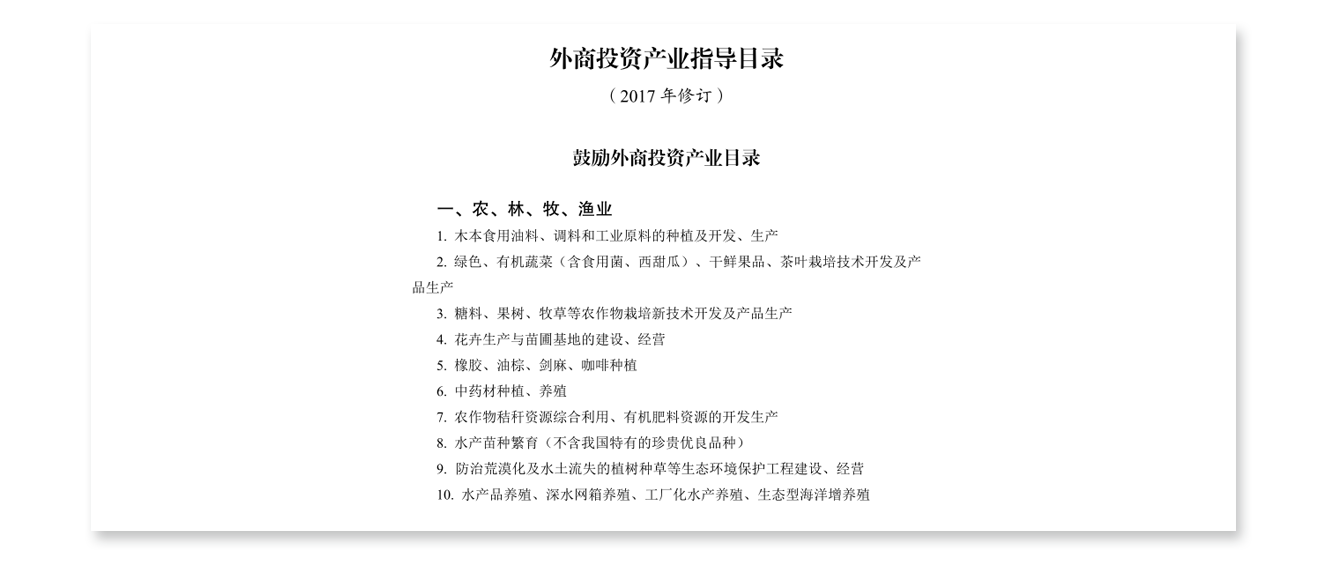

* Market Research

Before

investing in China, you need to know in which category does your

business belong to, that is, Encouraged, Restricted or Prohibited. RTF

can assist to understand your business by analyzing the market itself

and its competitors and come up with a feasible conclusion. The

administration of foreign investment are regulated by the Ministry of

Commerce (MOC) and National Development and Reform Commission (NDRC) and

their relevant subordinate bodies. For more details, you might refer to

the “Catalogue for the Guidance of Foreign Invested Enterprises”, which

is a policy document governing foreign investment into China and it can

be accessed (@link)

Catalogue for the Guidance of Foreign Investment Industries

For instance, if your business is not prohibited, RTF will collect your competitor’s information like registered capital, business scope, licenses, and so on, through the National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn/index.html+) to better understand your business and advise you accordingly.

Information of KFC shanghai extracted from the National Enterprise Credit Information Publicity System

In addition, we also analyse your competitors corporate structure, to further advise you on the right and most tax effective structure.

Example of KFC’s business structure in China

* China Tax System

The

most common taxes to businesses are Value Added Tax (VAT) and Corporate

Income Tax (CIT). VAT rate ranges from 0% to 16%, depending on the type

of goods and services supplied while standard CIT rate is set at 25%.

In some cases, lower tax rates might be granted by the Chinese Tax

Bureau, such as VAT exemption and reduced CIT rate, only if the

necessary conditions are met. More information about the China tax

system and the relevant tax rules and regualtions can be accessed (@link)

For

more professional advice regarding tax matters, you can contact our

global tax advisers. They can provide tailored tax advisory services

based on your business strategy and requirement, for instance:

• Whether you need to set up a holding company in Hong Kong, Singapore or other jurisdictions?

• How to meet the requirements of different VAT/CIT incentive policies?

• Is your profit rate within the reasonable range for related parties transactions?

• What are the different tax risks to be aware of?

• Is your business eligible for any local government subsidies?

* Foreign Exchange Policy and Bank Account in China

Chinese

government has implemented strict regulatory control over the exchange

of foreign currencies. All foreign-invested enterprises are required to

open at least two type of bank accounts, one is the capital contribution

account and the other one is the RMB basic account. The capital

contribution account is meant for only the receipt of foreign currency

as capital. For use of the funds in the capital account for daily

operations, the funds will have to be transferred to the RMB basic

account. For business dealing with overseas, a foreign currency bank

account may also be opened, depending on your needs and requirements.

For information regarding funds repatriation, including dividend

distribution, in terms of regualtions, procedures and so on, please

visit our website (@link) or feel free to contact us.

* Business Registration

Once

you have decided to invest and conduct your business in China, RTF will

assist in getting the business registered at different government

departments, for instance, Administation for Industry and Commerce

(AIC), Commission of Commerce (COC), State Adminstration for Foreign

Exchange, (SAFE), State Administration for Taxation (SAT) and so on.

Normally, it will take about 1-3 months to get the company established,

but again it will depend on the nature and complexity of the business.

For more information about business registration in China, please visit

our website (@link)

* Financial Outsourcing

Due

to the annual audit requirement imposed by the Ministry of Commerce

(MOC), all the foreign-invested enterprises are advised to prepare

accounts (Profit or Loss statement and balance sheet) once the business

has been registered and the tax registration has been completed. Due to

the differences between the International Financial Reporting Standards

(IFRS) and the Chinese Financial Reporting Standards (Chinese FRS), it

is advisable to either employ our own local professional accountant or

outsource the accounting work to a professional firm like RTF. For more

information, please check our website (@link)

* Business Consultancy

Being

new to the Chinese market, you may have lack of knowledge regarding the

laws and regulations of conducting and operating the business. For

example, if you are planning to provide beauty services and sell

imported cosmetic products in shopping malls, you may come up with the

following concerns:

• Is it necessary to register a subsidiary for each outlet?

• How to acquire cosmetic products, by centralized procurement or decentralized procurement?

• How to improve the efficiency and effectiveness of inventory management?

• Is there any additional special license/permit needed for conducting the business?

• What are the annual compliance work required?

All

these concerns can be clarified by RTF through a one-time consultancy

meeting or report. Throughout all these years, RTF has accumulated

plentiful experience over different industries, covering e-commerce,

technology, pharmaceuticals, trading, finance and etc and we are very

familiar with all the likely implications. Please check our website (@link) for more information about our business consulting services.

* Tax planning

To

encourage the development of some specific industries in China, the

Chinese government has brought forward tax exemption and tax relief

policies. For example, Chinese tax bureau offers VAT exemption or VAT

tax refund on cross-border taxable services and reduced CIT tax rate for

Advanced Technology Service Enterprises (ATSE). Only if all

requirements are met, these tax incentives applied for on an application

or filing basis.

For companies having business overseas or

repatriating earnings overseas, there is a possibility both foreign tax

and China tax might be applicable, more specifically, the enterprise

will accounted for withholding tax in China and corporate/personal

income in the overseas country. Is there a possibility to avoid or

reduce this tax burden? Yes it will depend on whether or not China has a

tax treaty with with the overseas country and also on the nature of the

transactions. Being a global tax expert, RTF is familiar with the tax

law in different jurisdictions such as Singapore, Hong Kong, UK,USA

and so on and we can provide you with the best tax planning solutions.

For more details about our tax planning service, please refer to our

website:(@link)

If you would like to have a even more broader knowledge and insight before investing into China, you may consider our hourly consulting service, charged at rate of 500 USD.

Address: Room 708, Allianz Building, 38 East 3rd Ring North Road, Chaoyang District, Beijing 100026,PRC

Address: 3107, Shanghai Merchants Tower, No. 161 Lujiazui East Road, Pudong District, Shanghai 200120,PRC

Room 1001 Broadengate Software Tower Binhai Avenue Nanshan District Shenzhen,shenzhen 518056,PRC

9 Temasek Boulevard, Suntec Tower 2, #09-01 Singapore 038989

Address: 339 5th Avenue,Suite 501 New York,NY 10016

7000 Falls Reach Drive,#205,Falls Church VA 22043

We will contact you within 24 hours.